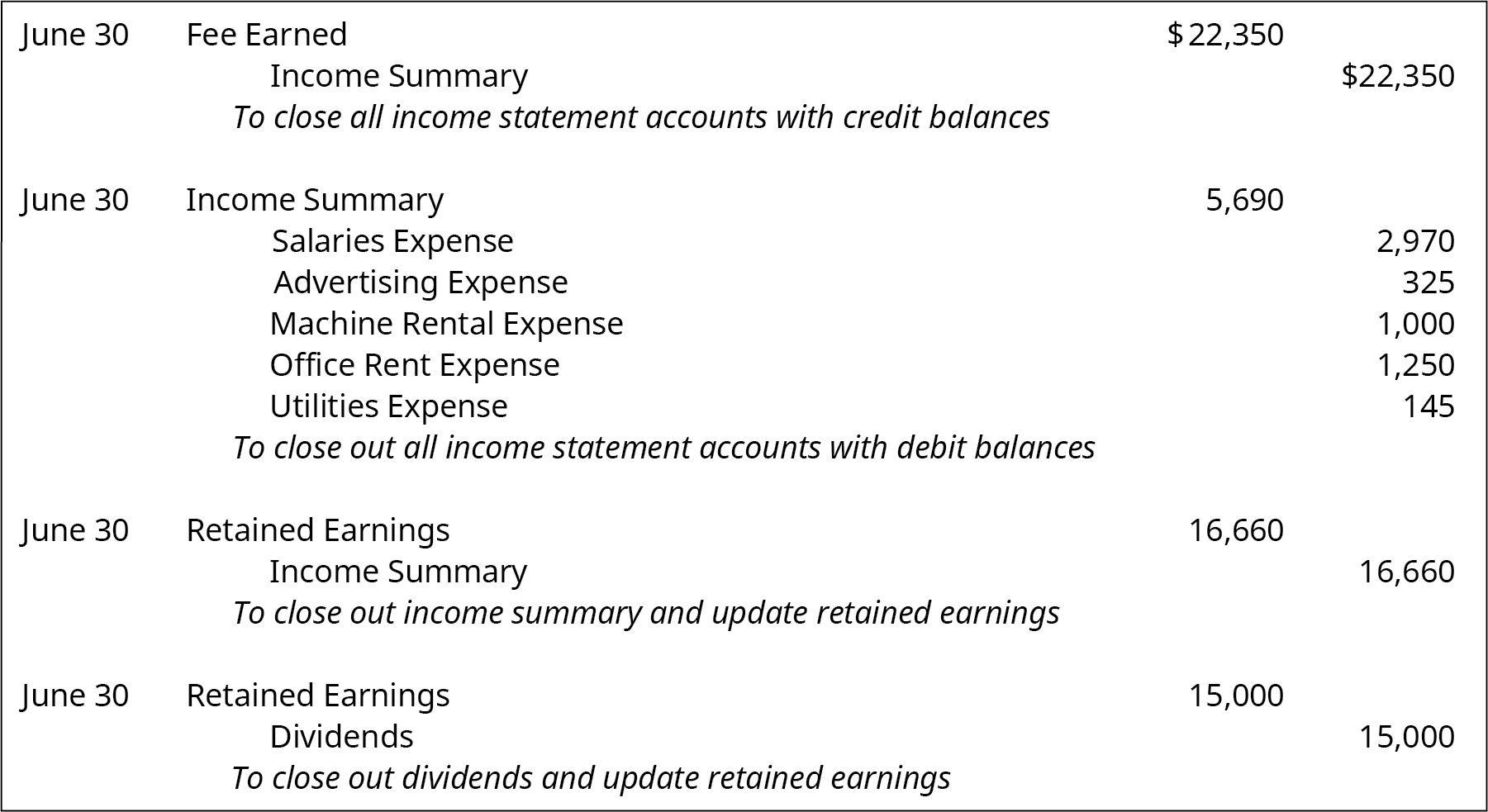

Closing your accounting books consists of making closing entries to transfer temporary account balances into the business’ permanent accounts. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account.

Accounting made for beginners

Closing the books not only helps to ensure the accuracy and completeness of the financial statements but also provides a clean set of books for the next accounting period. Now that we have closed income and expenses, we need to move the balances from the income summary to retained earnings. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns. However, most companies prepare monthlyfinancial statements and close their books annually, so they have aclear picture of company performance during the year, and giveusers timely information to make decisions. The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account.

What Is Net Income?

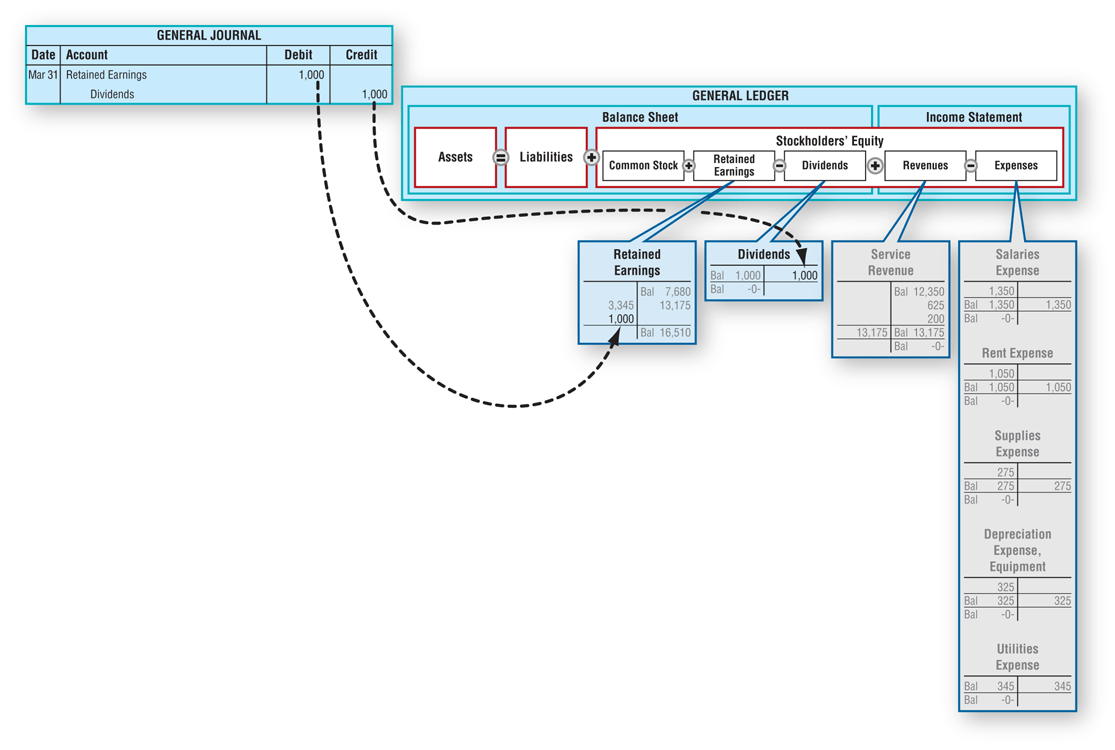

This is no different from what will happen to a company at theend of an accounting period. A company will see its revenue andexpense accounts set back to zero, but its assets and liabilitieswill maintain a balance. Stockholders’ equity accounts will alsomaintain their balances. In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts.

Step 1: Close all income accounts to Income Summary

What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year? You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. After preparing the closing entries above, Service Revenue will now be zero.

- All of these entries have emptied the revenue, expense, and income summary accounts, and shifted the net profit for the period to the retained earnings account.

- You will notice that we do not cover step 10, reversing entries.

- Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year.

- The remaining balance in Retained Earnings is$4,565 (Figure5.6).

- Why was income summary not used in the dividends closing entry?

We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the Income Summary account. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period.

Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period. All revenue accounts are first transferred to the income summary. Here you will focus on debiting all of your business’s revenue accounts.

Using the above steps, let’s go through an example of what the closing entry process may look like. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. Below are the T accounts with the journal entries already posted. We’ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars. Here are MacroAuto’s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view. However, if the company also wanted to keep year-to-date information from month to month, a separate set of records could be kept as the company progresses through the remaining months in the year.

State whether each account is a permanent or temporary account. You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app. That’s why most business owners avoid the struggle by investing in cloud accounting software instead. Lastly, if we’re dealing with a company that distributes dividends, we have to transfer these dividends directly to retained earnings. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to “Retained Earnings”.

The $10,000 of revenue generated through the accounting period will be shifted to the income summary account. In this example, the business will have made $10,000 in revenue over the accounting period. Within this time it will have also incurred expenses of $9,000.

Let’s move on to learn about how to record closing those temporary accounts. Manually creating your closing entries can be a tiresome and time-consuming process. And unless you’re extremely knowledgeable revenue recognition in how the accounting cycle works, it’s likely you’ll make a few accounting errors along the way. Remember that all revenue, sales, income, and gain accounts are closed in this entry.